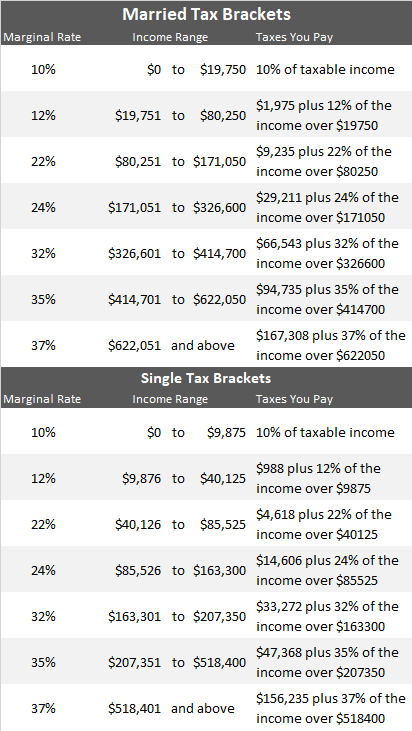

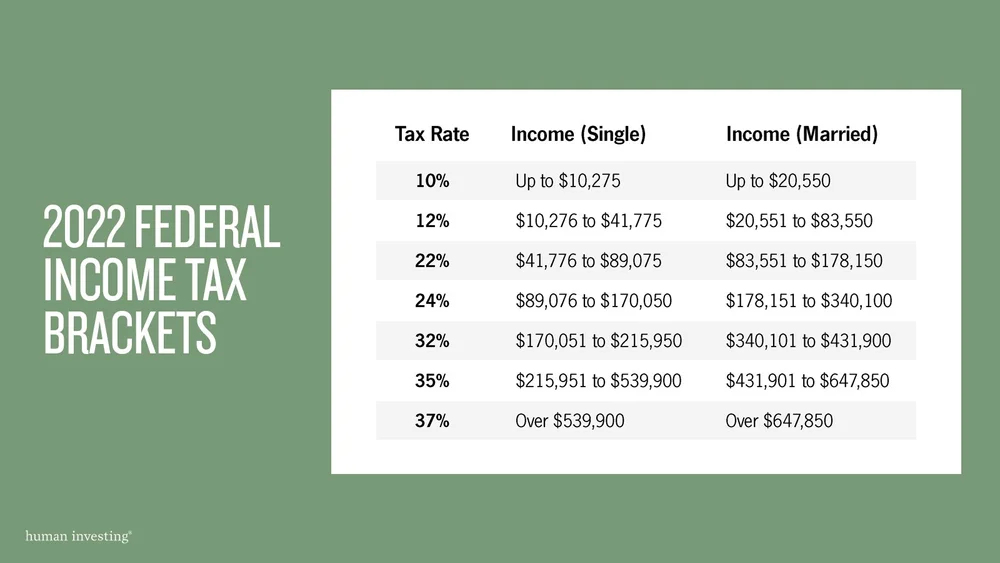

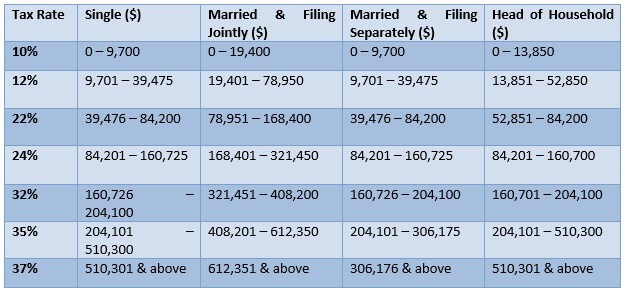

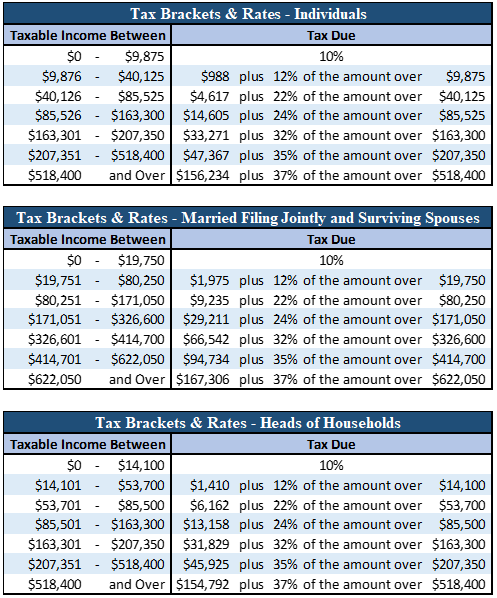

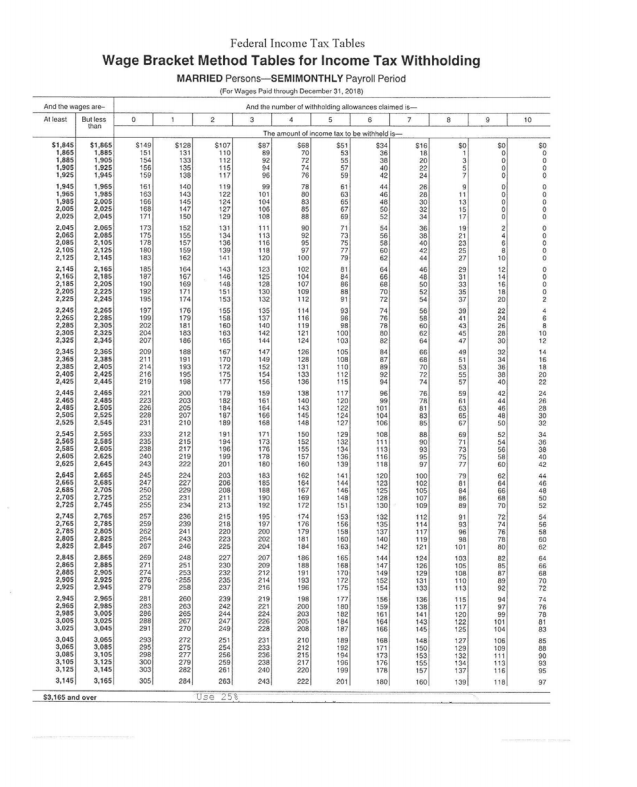

Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021 Federal Income Tax Rates & Brackets, Etc., and 2021 Michigan Income Tax Rate and Personal Exemption Deduction - Joseph W. Cunningham, JD, CPA, PC

What Is the Average Federal Individual Income Tax Rate on the Wealthiest Americans? | CEA | The White House